A Decade of Growth for Energy Midstream?

Inside this issue

Energy midstream moves the molecules to markets for industrial and consumer products. Look around today at the transmission lines, gathering facilities, pipelines, compressors, stations, etc — these are owned and operated by midstream energy businesses.

The product set is diverse and varies across geographies due to the types of products, including natural gas, natural gas liquids, crude, CO2, or renewable natural gas. Each product has its own specifications for transport and is regulated by FERC, EPA, or state agencies.

Midstream is poised for a decade of growth:

1. Global oil demand returning to pre-pandemic levels

2. Improved cash flow due to higher commodity prices

3. Carbon market trading and pricing

4. Upside for hydrogen + CCUS markets

5. Upside for renewable natural gas (RNG)

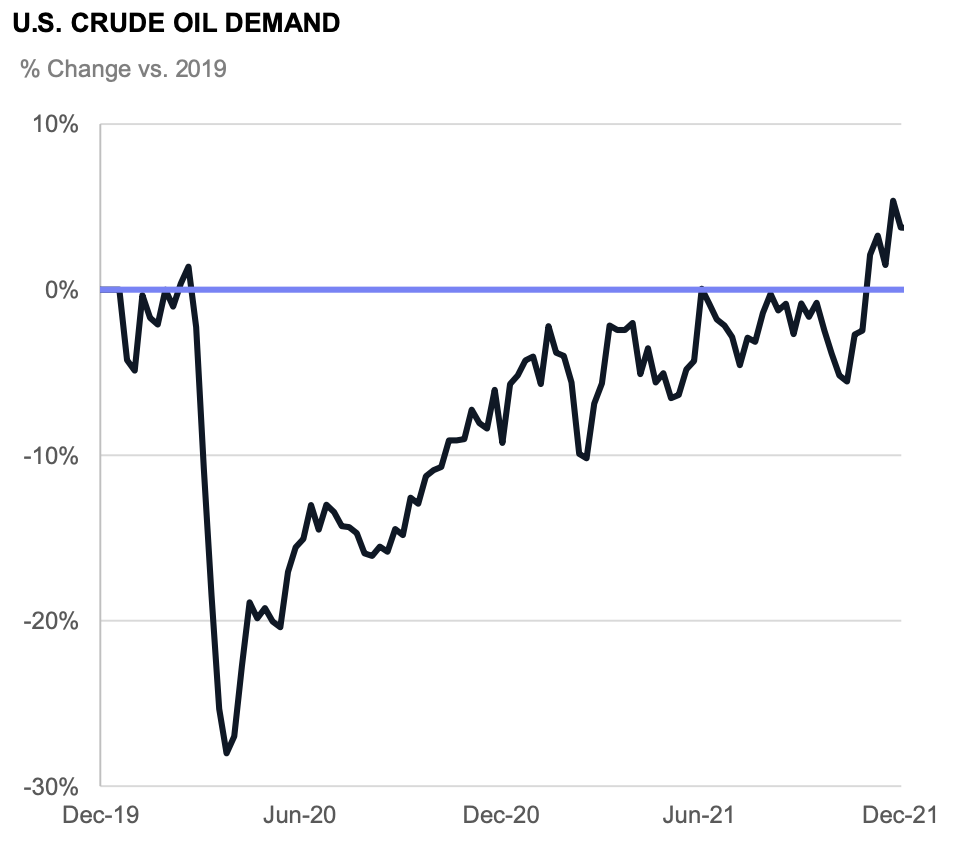

Oil demand returns to 2019 levels

The energy midstream business is supported by oil demand in the US and globally. As of Q4’21, global oil demand returned to pre-pandemic levels with diesel, gas, and aviation fuel demand returning to 2019 levels.

Source: Goldman Sachs Investment Research

The energy crisis in Europe demonstrates the need for hydrocarbons in the overall energy system. Energy reliability will continue to be important to each country and the stability of the current system will aid the energy transition over time.

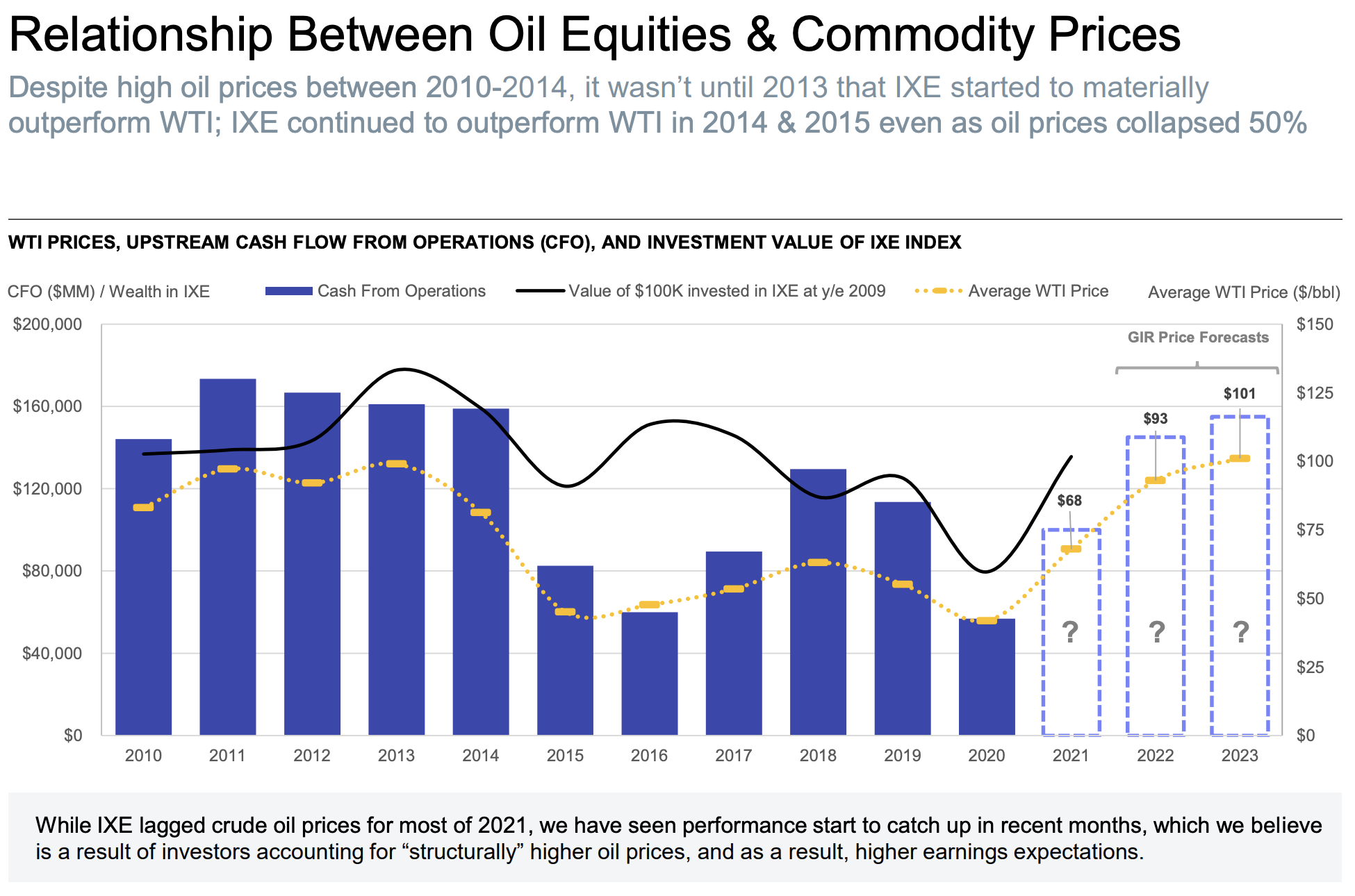

Improved cash flow due to higher commodity prices

With oil currently in the $90’s/bbl and gas above $5 mcf, Upstream and Midstream operators are expected to see higher cash flows in 2021. Already during the Energy earnings seasons BP, Shell, and others have delivered record profits. After a tumultuous 2020 and restructuring of organizations across the industry, capital discipline and cash flow to shareholder remains a key theme for executive teams. Upstream and Midstream profits will enable these companies to evaluate and deploy lower-carbon solutions while maintaining their oil and gas business.

Source: Goldman Sachs Investment Research

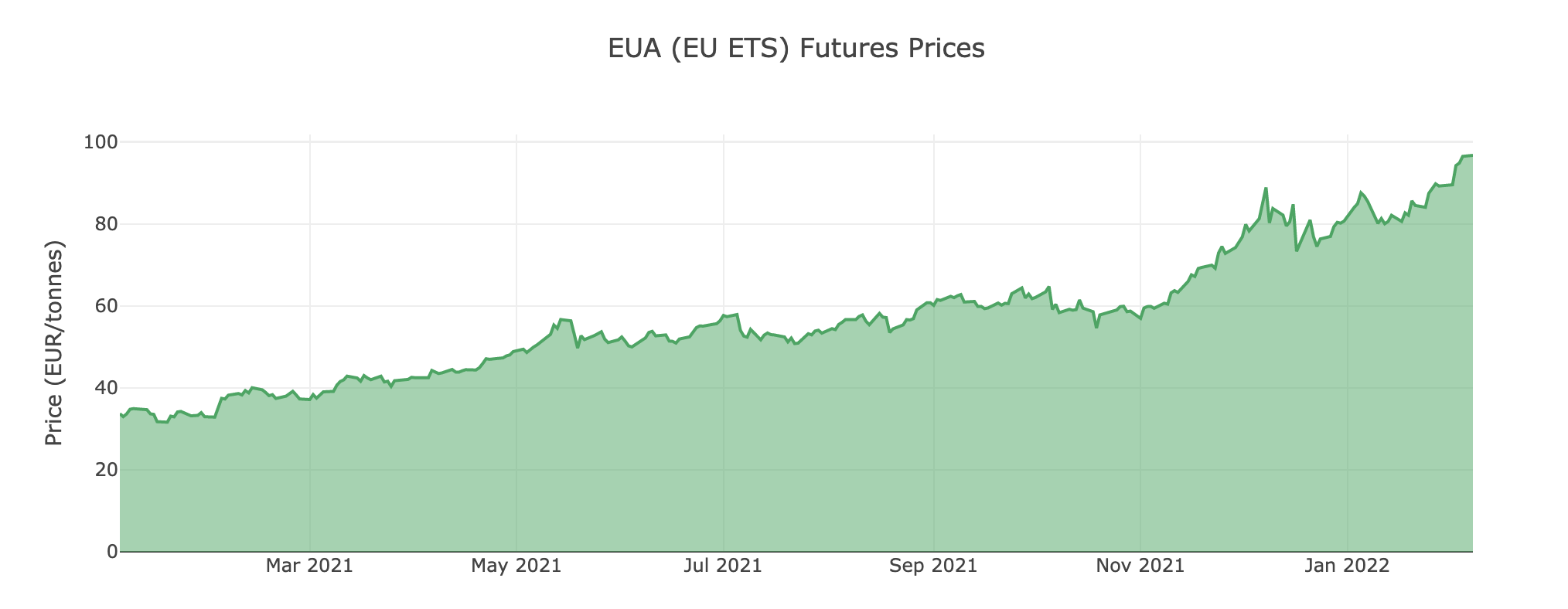

Carbon market trading and pricing

The midstream businesses already have sophisticated commercial supply and trading teams that operate different commodities. With teams and systems in place, adding a new commodity and trading regulations for midstream operators will not be as difficult as a new entrant or boutique carbon trading company.

Carbon prices continue to rise in the EU, California, and RGGI. Each of these markets have different levels of participation and regulation. For international midstream companies, the carbon markets presents new opportunities to participate in these emerging carbon market initiatives.

Source: Ember-climate.org

Upside for hydrogen + CCUS markets

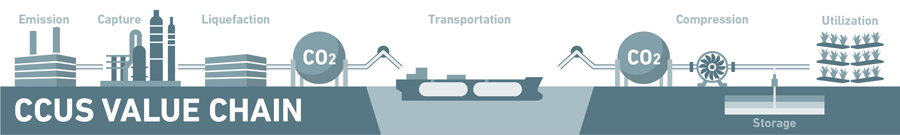

Transportation, storage, and compression is a critical piece to the hydrogen and CCUS markets. Midstream companies today have existing energy infrastructure, right of ways, and trading capabilities to bring to the hydrogen and CCUS markets.

Source: MHI

In January, Buckeye Partners invested in OneH2 to build out OneH2's hydrogen system and create hydrogen fuel demand. Enlink Midstream and DCP Midstream are focusing on CCUS opportunities in their regions of operations.

Kinder Morgan owns the largest commercially available CO2 pipeline system available. If CCUS adoption scales, then point solutions and regional hubs will be required. Point solution would likely have or use their own facility to transport and sequester CO2. However, regional hubs will need miles of CO2 pipelines that do not exist today. Kinder Morgan and other midstream operators will transfer the CO2 from source to sequestration or utilization site.

Upside for RNG

Major pipeline connections allow RNG to get to market. Working with RNG producers midstream operators can add another product to their mix. RNG sources can include landfills, farms, livestock, wood, and others, gas quality at the transmission lines are a key concern. Midstream operators in the field and office have the expertise to identify these risks, address the concerns, and bring the gas to market.

In 2021, Kinder Morgan purchased Kinetrex Energy for $310 million. Renewable natural gas (RNG) creates additional opportunity for energy midstream businesses to get further into renewables and achieve lower-carbon solutions.

Harvest Midstream is partnering with NOVUS to convert wood waste into renewable natural gas.

Conclusion

Midstream companies are poised for excellent growth and opportunities in low-carbon markets while their core business is underpinned by higher commodity prices. The companies that take calculated risks to partner and offer low-carbon solutions will be able to leverage their internal skills, commercial knowledge, and product expertise to create new revenue streams.

Inside this Issue

♻️ Phillips 66 and H2 Energy Europe to develop hydrogen refueling network in Germany, Austria and Denmark

🚢 Mitsubishi Shipbuilding Concludes Agreement on Construction of World’s First Demonstration Test Ship for Liquefied CO2 Transportation

🛢 BP rejects calls for UK windfall tax after biggest profits in eight years

🌎 Climate Pledges of Amazon, Google, Walmart, Others Found to Have Low Integrity

Articles in this issue