Alaska Energy Metals to Explore Natural Hydrogen Resource Potential at the Angliers-Belleterre Project, Quebec, Canada

Published by Todd Bush on October 16, 2024

Highlights:

- Alaska Energy Metals owns claims adjacent to hydrogen soil gas anomalies recently discovered by Quebec Innovative Materials Corporation; these anomalies indicate potential for discovery of natural hydrogen (also known as white hydrogen) accumulations.

- White hydrogen is a naturally occurring, geologically created type of hydrogen that is gaining prominence as a low-cost, low emission, and renewable clean energy source.

- Alaska Energy Metals’ claims cover source rocks, possible gas migration pathways, and potential reservoir rocks that can trap accumulations of hydrogen gas.

- Hydrogen detected by testing gases in soil could lead to the discovery of hydrogen gas accumulations trapped in rocks below surface.

- Alaska Energy Metals plans to carry out soil gas sampling as an initial step in evaluating the potential for white hydrogen accumulations on its Angliers–Belleterre claims.

VANCOUVER, British Columbia, Oct. 16, 2024 (GLOBE NEWSWIRE) -- Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF) (“Alaska Energy Metals,” ”AEMC,” or the “Company”) today announced its plans to carry out a hydrogen soil gas survey over a portion of its Angliers-Belleterre Project (“Angliers”) in Quebec to determine if the project holds potential for natural, white hydrogen accumulations.

>> In Other News: Brazil's Petrobras and Miner Vale Have Decarbonization Partnership in Works

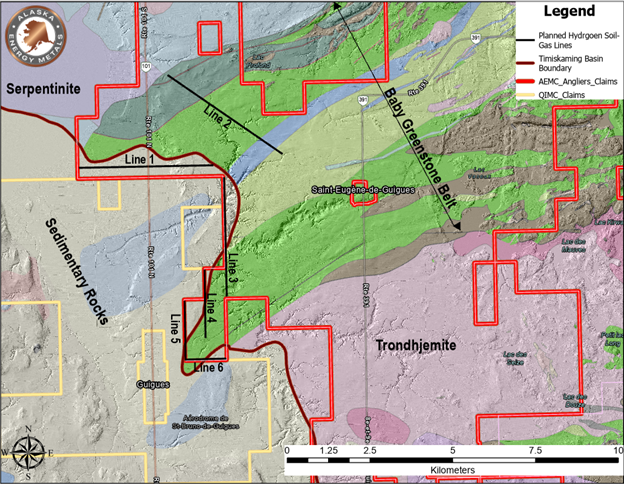

Recent soil gas sample data released by adjacent claim owner Quebec Innovative Materials Corporation illustrates the potential for hydrogen accumulations to occur within the Lake Timiskaming Basin of western Quebec, which intersects with various parts of the Baby Greenstone Belt on AEMC’s Angliers claim block (Figure 1).

The accumulation of hydrogen in the basin is likely to occur from the serpentinization of iron-rich basement rocks of the Baby Greenstone Belt, which consist of serpentinite, komatiite, basalt, peridotite, and iron formation.

“AEMC acquired the Angliers project for its nickel-copper potential and has been doing exploration aimed at those commodities. We will continue to advance the nickel-copper targets that we’ve identified. However, we are excited to learn of the hydrogen soil gas anomaly discovery in the Lake Timiskaming Basin made by our claim neighbors, Quebec Innovative Materials Corporation,” said Alaska Energy Metals Chief Geoscientist Gabe Graf.

“Natural hydrogen has gained prominence as a potential contributor to the low carbon energy landscape. Both the industry and governments worldwide have shown a growing interest in natural hydrogen exploration, which may form an important part of the future energy mix. The formation of white hydrogen requires the correct rock types and geologic processes to create the hydrogen gas, gas migration pathways, and geologic traps or reservoirs at which the gas may accumulate. It appears we may have these features on our claims. Our planned work will help determine if there is indeed potential for white hydrogen gas on our claims.”

The company plans to collect approximately 400 soil gas samples across six lines on its claim block.

Five of these lines will be collected near the interpreted contact of the Lake Timiskaming Basin with the Baby Greenstone Belt, where the company believes the fracture density and deep-seated faulting may be sufficient to allow a pathway for hydrogen, created during serpentinization to reach the surface.

Hydrogen detected in soil may be indicative of hydrogen gas trapped below surface. In addition, one line of samples will be collected over in-situ serpentinite, komatiite, iron formation, and basaltic rocks to analyze the potential for hydrogen creation outside of the basin.

Figure 1. Planned AEMC soil-gas survey lines on the Angliers-Belleterre project. Geological map sourced from_ SIGÉOM (Ministère des Ressources naturelles et des Forêts).

QUALIFIED PERSONGabriel Graf, the Company’s Chief Geoscientist, is the qualified person who reviewed and approved the technical disclosure in this news release.

For additional information, visit: https://alaskaenergymetals.com/

ABOUT ALASKA ENERGY METALS

Alaska Energy Metals Corporation (AEMC) is an Alaska-based corporation with offices in Anchorage and Vancouver working to sustainably deliver the critical materials needed for national security and a bright energy future, while generating superior returns for shareholders.

AEMC is focused on delineating and developing the large-scale, bulk tonnage, polymetallic, multi-critical Eureka deposit containing nickel, copper, cobalt, chromium, iron, platinum, palladium, and gold. Located in Interior Alaska near existing transportation and power infrastructure, its flagship project, Nikolai, is well-situated to become a significant domestic source of strategic energy-related metals for North America. AEMC also holds a secondary project in western Quebec, the Angliers – Belleterre project, which has the potential for high–grade nickel-copper sulfide deposits and white hydrogen. Today, material sourcing demands excellence in environmental performance, carbon mitigation, and the responsible management of human and financial capital. AEMC works every day to earn and maintain the respect and confidence of the public and believes that ESG performance is measured by action and led from the top.

ON BEHALF OF THE BOARD_“Gregory Beischer”_Gregory Beischer, President & CEO

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

-

$47M Just Poured Into This SAF Producer

Inside This Issue 💰 LanzaJet Announces $47M in New Capital and First Close of Equity Round at $650M Pre-Money Valuation 🚢 Maersk's Ethanol Bet Could Reshape U.S. Fuel Markets 🪨 Canada Nickel and t...

Company Announcements

-

Feedstocks are Perennial Grasses and other Renewable Biomass Sources FREDERICK, Md., Feb. 18, 2026 /PRNewswire/ -- Do you know why passenger and freight planes are not using renewable biofuel? It'...

-

Vancouver, British Columbia--(Newsfile Corp. - February 25, 2026) - Q Precious & Battery Metals Corp. (CSE: QMET) (OTC Pink: BTKRF) (FSE: 0NB) ("QMET" or the "Company") congratulates Quebec Inn...

-

Carbon Direct and C2X Announce Collaboration on Pioneering Forestry Residue-to-Biofuel Project

Collaboration on C2X’s Beaver Lake Biofuels project advances biomass carbon removal and storage as a scalable climate solution, transforming Louisiana’s forestry and sawmill residues into biofuel a...

-

Carbon Direct and C2X Announce Collaboration on Pioneering Forestry Residue-to-Biofuel Project

Collaboration on C2X’s Beaver Lake Biofuels project advances biomass carbon removal and storage as a scalable climate solution, transforming Louisiana’s forestry and sawmill residues into biofuel a...