BP's Indiana Exit Is Not the Endgame for Clean Hydrogen

Published by Todd Bush on June 19, 2025

A surprising pause in the Midwest hydrogen story

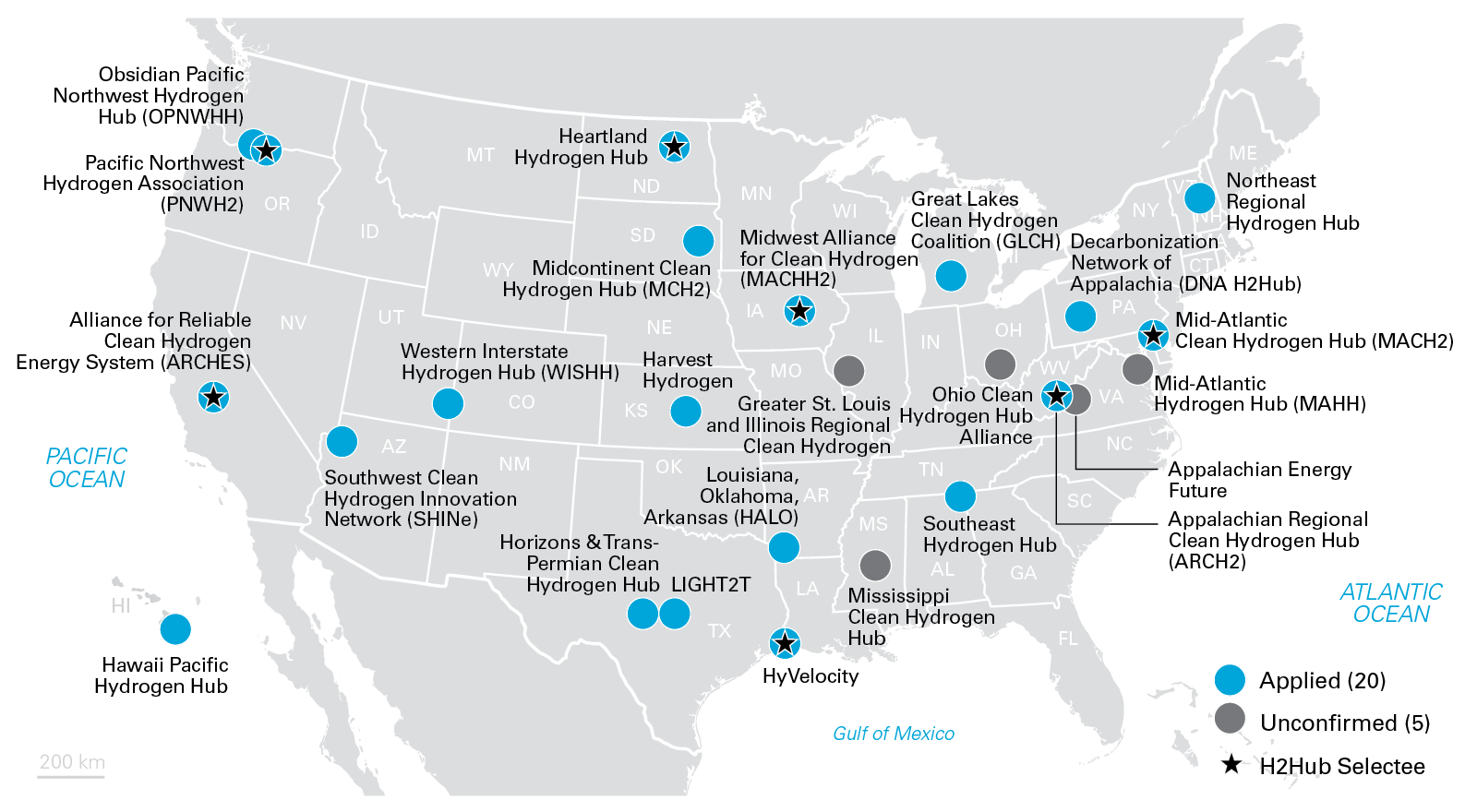

When BP confirmed it's shelving its blue hydrogen and carbon capture plans at the Whiting Refinery in Indiana, it sent a shockwave through the industry. This wasn't just any project. It was a flagship effort within the federally supported Midwest Alliance for Clean Hydrogen (MachH2), tied to the Biden administration’s $7 billion hydrogen hub initiative. Suddenly, one of the country’s most visible clean hydrogen proposals is on ice, and critics are quick to call it a step back.

But is it really?

>> RELATED: US Awards Up to $2.2 Billion to Speed Clean-hydrogen Development

Understanding the context

According to Hydrogen Insight, BP cited three key reasons for its withdrawal: economic uncertainty, a slow-moving hydrogen market, and a renewed focus on traditional oil and gas. It’s not a secret that global energy markets are shifting under pressure, and BP’s leadership appears to be steering toward safer bets, for now.

The Whiting project had aimed to produce hydrogen from natural gas while capturing and storing the resulting CO₂ emissions underground. It was part of a broader regional network funded by the U.S. Department of Energy to develop a reliable and scalable hydrogen economy.

Local pushback made noise

Part of what complicated the project was resistance from communities near proposed CO₂ storage sites. Counties like Benton, Pulaski, and Jasper were slated for underground injection infrastructure, but locals weren’t convinced. Concerns over water contamination, seismic risk, and long-term liability weighed heavily on public hearings.

John Gick, a commissioner in Benton County, expressed that "there’s just too many unknowns," and he wasn’t alone. Activists and environmental groups such as Just Transition Northwest Indiana criticized the project’s proximity to homes, schools, and farmland.

Lisa Vallee, a local resident and organizer, said “They are backing away from [climate goals] when it is no longer profitable.”

>> RELATED: BP Pauses Project to Pipe, Store Carbon Emissions Underground in Indiana Indefinitely

Bigger trend or isolated event?

BP’s move isn’t happening in a vacuum. In February 2025, the company slashed $5 billion from its renewable energy portfolio. Similar retreats have been seen across the board: Air Products canceled a major hydrogen facility in New York, and Nippon Sanso Holdings Corporation abandoned plans in Alabama.

But while it’s tempting to see a collapsing house of cards, industry experts argue that this is part of a healthy market correction. Projects that don’t meet feasibility thresholds are being paused, while others that offer stronger commercial cases are moving ahead.

According to the International Energy Agency, global demand for low-emission hydrogen could reach 38 million tonnes by 2030, more than triple today’s levels. That long-term forecast keeps the investment case strong despite short-term volatility.

A pause, not a retreat

Despite the headlines, the clean hydrogen sector is still gaining momentum. Companies like ExxonMobil and Chevron are advancing large-scale hydrogen and carbon capture initiatives in the Gulf Coast and California. Even BP hasn’t exited the race entirely; it remains involved in hydrogen ventures in Europe and other parts of the U.S.

And the hubs program is still alive. Seven hydrogen hubs were selected for federal funding, including the MachH2 alliance. Whiting’s exit shifts the internal structure, but the broader momentum remains intact. Other hub members are expected to rebalance assets and continue development.

The opportunity for others to lead

Industry watchers believe BP’s exit could open doors for smaller, more agile companies. Firms focused on green hydrogen, produced via electrolysis powered by renewables, may step into the spotlight. In fact, some already are.

According to Canary Media, the Biden administration’s funding strategy favors diversity in technology and geography. That means the collapse of one project doesn’t cripple the entire initiative, it just reshapes it.

Hydrogen demand could triple by 2030, according to the IEA.

As Energy Secretary Jennifer Granholm has said in past press briefings, “We are committed to building a hydrogen economy that works for everyone, from the Gulf Coast to the Great Lakes.”

>> In Other News: DNV Introduces New Service Specification SE-0696 to Mitigate Risks in CCUS Projects With Standardized Independent Technical Assurance

What's next?

The pause at Whiting shows that hydrogen still has growing pains. But it also shows that the industry is being stress-tested. Weak spots are being exposed, and that’s good. Projects that move forward from here will have more rigorous planning, stronger community engagement, and clearer return on investment.

In a way, this pivot could be the wake-up call the sector needs.

What’s clear is this: the hydrogen economy isn’t dead. It’s maturing.

And the next chapter might be even more transformative.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

Company Announcements

-

Carbon Removal Coalition Forms With Goal of Attracting $100-million in Project Investments

Leaders in Canada’s nascent carbon-removal industry have joined with several corporate and financial backers as well as the federal government in a bid to attract $100-million in project investment...

-

New Coalition Targets $100M for Canadian Carbon Removal Projects by 2030

An emerging industry to remove carbon dioxide out of the atmosphere got a boost on Thursday with the launch of an initiative to raise another $100 million for those projects. An emerging industry ...

-

TOKYO, March 6, 2026 /CNW/ - Canada is focused on what we can control – strengthening our economy at home and diversifying our partnerships abroad, including in the Indo-Pacific. Japan is an over $...

-

The Government of Canada, BMO, ClimeFi, NorthX, RBC, Shopify, and Vancity launch the "Advance Carbon Removal Coalition" to advance demand for Canadian CDR. OTTAWA, ON, March 5, 2026 /CNW/ - Canada...