EIA: US Biodiesel And Renewable Diesel Imports Fall Sharply In 2025 After Tax Credit Change

Published by Todd Bush on September 5, 2025

September 5, 2025BY U.S. Energy Information Administration

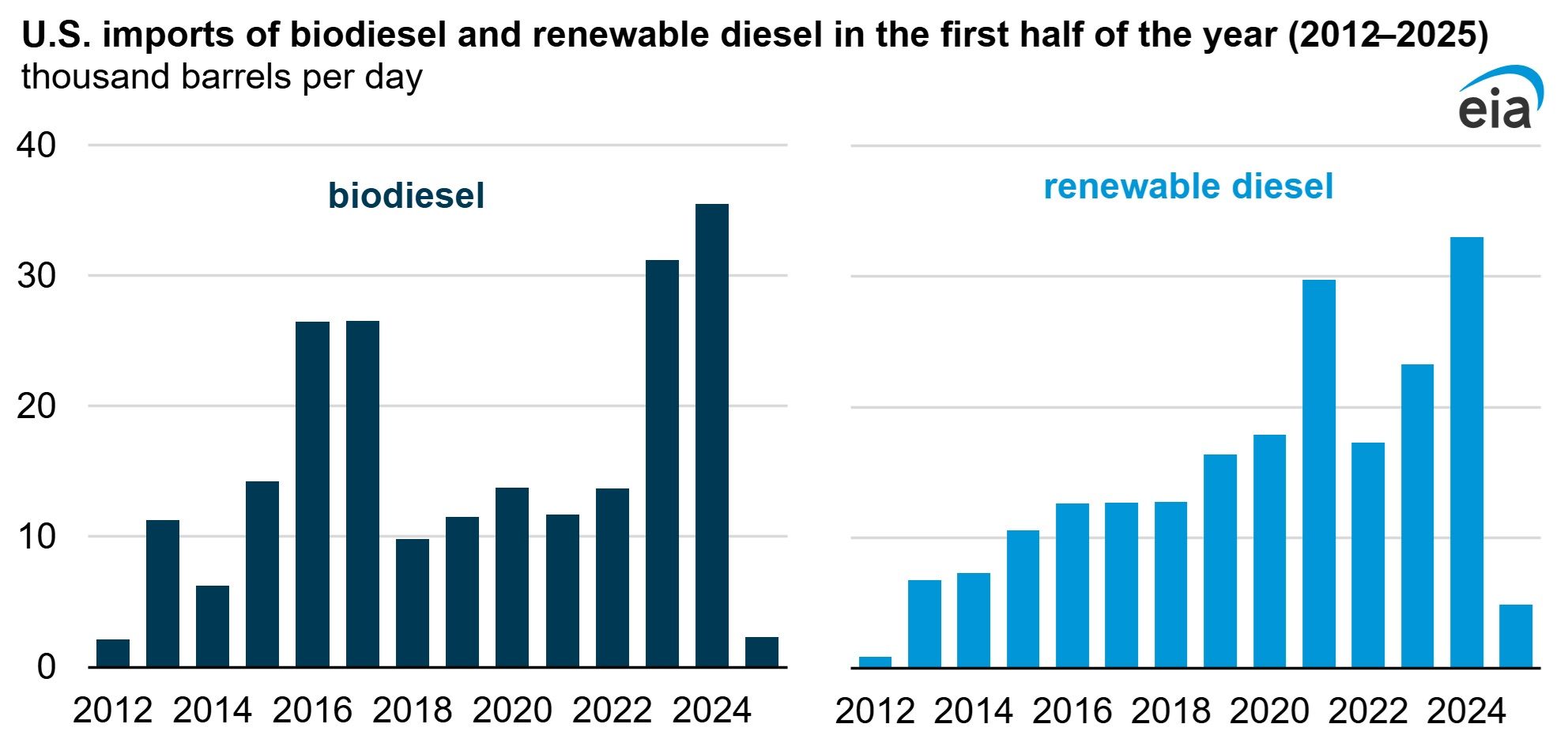

U.S. imports of biodiesel and renewable diesel significantly decreased in the first half of 2025 (1H25) compared with the same period in previous years. This decline is primarily due to the loss of tax credits for imported biofuels and generally lower domestic consumption of these fuels.

Renewable diesel and biodiesel are biomass-based diesel fuels that can replace petroleum-based distillate and be used to comply with the Renewable Fuel Standard blending requirements for refiners administered by the U.S. Environmental Protection Agency.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly Note: Consumption is defined as product supplied plus refinery and blender net inputs.

>> In Other News: US SAF Production Hits Critical 30,000 BPD Milestone

In 1H25, U.S. biodiesel imports averaged 2,000 barrels per day (b/d), a sharp drop from 35,000 b/d in 1H24. Renewable diesel imports averaged 5,000 b/d, down from 33,000 b/d in 1H24. These import levels were the lowest for the first half of any year since 2012, when U.S. biodiesel consumption was less than half of 2024 levels and renewable diesel consumption was negligible.

One key reason for the sharp drop in biodiesel and renewable diesel imports in early 2025 is the loss in tax credits for imported biofuels. Before 2025, both imported and domestically produced biodiesel and renewable diesel received a $1 per gallon blender’s tax credit (BTC). The Inflation Reduction Act replaced the BTC with the Section 45Z Clean Fuel Production Credit in 2025, which only applies to domestic production. This tax credit change placed imports at a relative economic disadvantage.

A second reason biodiesel and renewable diesel imports dropped in 1H25 was low U.S. consumption of these fuels because of uncertainty around blending requirements and negative profit margins for blending biofuels. Compared with 1H24, U.S. consumption of renewable diesel was down about 30% in 1H25, and biodiesel consumption was down about 40%. This lower consumption reduced demand for both imported and domestically produced biofuels.

The combination of poor blending margins and the relative economic disadvantage for imported biofuels led domestic blenders to rely on domestically produced biofuels for the smaller amounts they were blending. As a result, international biofuel producers found fewer profitable opportunities to send product to the United States. For example, Neste, the producer of all of the renewable diesel imported to the United States, reported a lower share of exports going to the United States in 1H25 than in 1H24. Looking ahead, we expect U.S. consumption of biodiesel and renewable diesel to increase as the year progresses to meet existing RFS mandates, but imports of the fuels will likely remain low because of the change in tax policy.

Although we do not explicitly forecast biodiesel and renewable diesel imports in the Short-Term Energy Outlook, we do forecast U.S. net imports. We assume low imports for both products in the forecast period and forecast U.S. biodiesel net imports in 2025 and 2026 to be their lowest since 2012.

About U.S. Energy Information Administration

The U.S. Energy Information Administration (EIA) collects, analyzes, and disseminates independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...