You can read the Overview of Emission Trading Systems in a previous issue.

The world is racing to combat climate change and reduce Greenhouse Gas (GHG) emissions. Major initiatives are being taken in different regions of the world to reduce emissions, decarbonize the economy, and lower the environmental impact of asset-intensive industries.

>> In Other News: DEN - Denbury Resources - Earnings Call Transcript Q3 2021

Emission Trading Systems or ETS is a market-based tool which advanced economies have adopted to reduce global emissions and to tackle climate change. The World Bank illustrates how countries are implementing ETS or carbon taxes.

Source: World Bank

The major initiatives in the world are the European Union's ETS program along with ETS initiatives in major economies such as the US, Canada, China, Japan, and Korea.

EU Emission Trading System

The EU ETS operates in all EU countries plus Iceland, Liechtenstein, and Norway. It proposes to limit emissions in 10,000 power installations, manufacturing sectors as well as airlines operating between these countries. It covers about 40% of the EU's green GHG emissions.

The EU ETS system is the first international system in the world and currently the largest. It works on a cap-and-trade principle. Cap is set on the total amount of GHG the installations can emit. The cap is reduced over time so that total emissions can fall over time. Within the cap, installations can buy or receive emission allowances which they can trade with one another as and when needed.

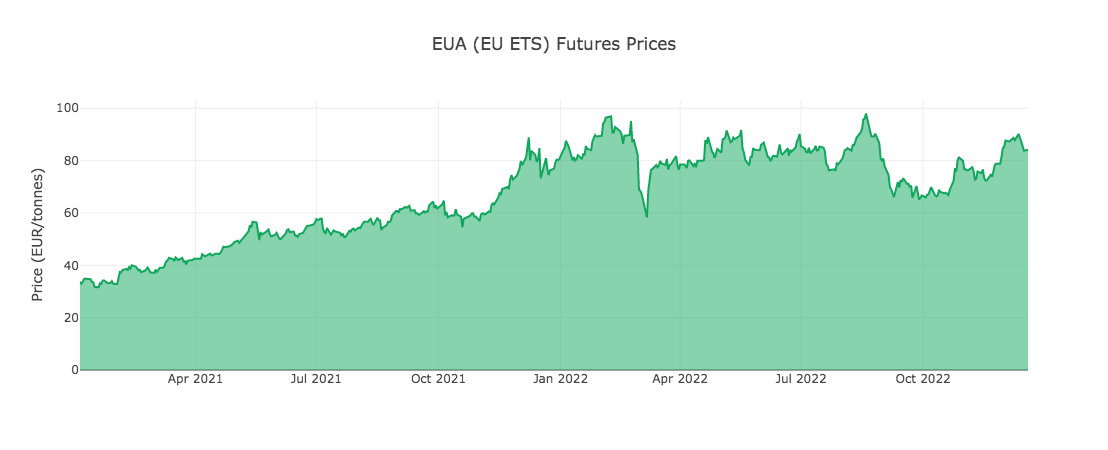

The limit on the total number of allowances available ensures it has a value. Carbon trading brings in flexibility, ensuring emissions are cut where it costs least to do so. A robust carbon price also promotes investment in innovative, low-carbon technologies. In 2022, the EU carbon prices reached an all-time high.

For more information, visit the websites of the EU ETS and the World Bank.

The EU has a cap on how much GHG pollution can be emitted each year, and companies need to hold European Emission Allowance (EUA) for every tonne of CO2 they emit within one calendar year. They receive or buy these permits and they can trade them.

The EU ETS is for CO2 emissions trading from power stations, energy-intensive industries (e.g., oil refineries, steelworks, and producers of iron, aluminium, cement, paper, and glass) and civil aviation.

Four Phases of EU ETS

EU ETS is a four-stage program and evolved in phases as described below:

- Phase I (2005-2007) was a learning phase where allowances were literally given free. It covered CO2 emissions from power and energy related industries where there was a penalty for noncompliance. It laid the foundation for a carbon price and trading and set up the necessary infrastructure for monitoring, verifying, and reporting.

- Phase II (2008-2012) coincided with the first phase of Kyoto protocol where concrete emission targets were set for individual countries in EU ETS. Key achievements of Phase II were lower cap on allowances, increased penalty for noncompliance of emission targets, introduction of an auction system, reduction in proportion of free allocation, joining of 3 countries Iceland, Liechtenstein and Norway, and bringing the aviation sector into ETS, allowing businesses to buy international credits.

- Phase III (2013-2020). In this phase reform process was accelerated including a single EU cap for emissions compared to individual national caps prevailing earlier, auctioning instead of free allocation for allocating allowances, harmonizing allocation rules, and including more sectors and gases in the emission caps

- Phase IV (2020-2030) of EU ETS is a part of Fit for 55 initiative which has set up new targets for ETS emissions. It has also included shipping in the list of CO2 emissions from large ships (above 5000 gross tonnage) irrespective of the flag they fly. The extension will include all emissions from ships calling at an EU port for voyages within the EU (intra-EU) as well as 50% of the emissions from voyages starting or ending outside of the EU (extra-EU voyages), and emissions that occur when ships are at berth in EU ports. Modifications have also been made in free emission allowances with conditions being imposed for decarbonization efforts. There is also a cap being proposed on aviation allowances in the ETS, introduction of a new trading system for transport and building sector, changes in the market stability reserve etc.

In June 2021, the EU adopted a European Climate Law, with the goal of establishing net zero GHG in the EU by 2050. The law sets an intermediate target of reducing GHG by at least 55% by 2030 compared to 1990 levels. The European Commission released the “Fit for 55” package in 2021 which places ETS at the heart of the decarbonization agenda.

The proposed steps include a one-off reduction in the cap, increased linear reduction factor (from 2.2% to 4.2%), introduction of Carbon Border Adjustment Mechanism (CBAM) that prices imported goods based on their embedded emissions (to be operational by 2026), inclusion of maritime sector into EU ETS, separate fuel ETS for building and transport, updated parameters for Market Stability Reserve (MSR) including a new buffer threshold, extension of current intake rate of 24% beyond year 2023, and setting up of social climate fund to spur new innovations.

EU ETS: Transitioning to Leader

The impact of all the above changes has had mixed results. Initially, EU ETS was seen as a slow sluggish performer with too many free allowances resulting in stagnant carbon prices. The CO2 reduction for the first decade was 1 billion tons which considering the period was very modest. This has started changing slowly but surely. Around 2018 with the introduction of many modern reforms, the price of permits has started a steep climb. Emission levels have also started showing a significant downturn with coal fired power generation being replaced by gas fired power generation and renewables.

ETS is slowly making coal power financially unviable. As a result, other industries such as iron and steel have been negatively impacted by fossil fuels and rising carbon price permits. This has laid a path for cleaner greener Europe as cost effective technology options are being pursued with greater vigor. However, still challenges persist on account of local problems in EU member states such as Germany, Poland, and withdrawal of UK from EU etc.

ETS by other leading countries around the world

Apart from EU ETS, many other nations have launched emissions trading programs to contain carbon emissions actively. Several other countries made progress on emissions trading.

China Initiated ETS Trading in 2021

China commenced its national ETS trading in July 2021 on a trading platform operated by Shanghai Environment and Energy Exchange (SEEE) after a series of initiatives at local government levels which had earlier commenced in 2013.

China’s key targets include peaking of carbon emissions by 2030 and carbon neutrality by 2060. China ETS covers about 2200 power companies including combined heat and power and captive power plants of other industries with projected cover of 4 billion of tCO2 (accounting for 40% of carbon emissions) making it the largest carbon market in the world by volume. Auctioning of allowances have not been allowed in the initial phases but may be allowed in later stages.

Japan Monetizes Carbon Credits

Japan commenced its ETS program in 2010 under the cap-and-trade program of the Tokyo Metropolitan Government. Under this program, large buildings, factories, heat suppliers, and other facilities which consume large units of fossil fuel were expected to comply with specific facility baseline emission norms. The Japan Ministry of Economy Trade and Industry has plans to start a carbon credit exchange market in fiscal year 2022-2023 to monetize local companies' carbon emissions to push for carbon neutrality.

This platform will not only trade in monetized carbon credits from CO2 in Japan but also from reduced emissions from ASEAN countries and voluntary credits from Europe and USA. Japan is, however, opposed to EU ETS plans regarding the shipping sector.

South Korea Launched ETS in 2015

Korea ETS was launched in January 2015 making it the second largest market for ETS after EU at the time of launch. Its proposed GHG target by 2030 is 24.4% below 2017 level emissions and net zero emissions by 2050. During the third phase (2021-25), it proposes to cover 6 sectors namely heat and power, industry, buildings, transportation, waste, and public sector.

In total, about 69 sub-sectors have been included. Starting from Phase III, financial intermediaries are allowed to participate in the secondary market and trade allowances and converted carbon offsets in Korea Exchange (KRX) to promote market liquidity. A futures market has also been proposed during Phase III.

USA Offers Different State Programs

The US was a pioneer in carbon emissions containment initially but lost momentum to EU, which became the leader in ETS. There are a few key ETS initiatives currently in progress in the US.

The Regional Greenhouse Gas Initiative (RGGI) is the first mandatory GHG ETS in the United States and covers emissions from the power sector. The system started operating in 2009 with 10 states (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, and Vermont) with New Jersey beginning participation in RGGI in 2020 and Virginia in 2021. Pennsylvania is looking into RGGI participation in 2022. Between 2021 and 2030, the RGGI cap will reduce by 30% compared to 2020. Furthermore, an emissions containment reserve (ECR) started operating in 2021.

California’s Cap-and-Trade Program began operation in 2012, with the opening of its tracking system for allocation, auction distribution, and trading of compliance instruments. The California program, which is implemented by the California Air Resources Board (CARB), covers sources responsible for approximately 80% of the state’s GHG emissions.

Canada's Cap-and-Trade Systems

Canada-Nova Scotia’s cap-and-trade program sets a cap on the total amount of GHG emissions allowed in covered sectors in the province for the years 2019-2022 (compliance period). Final cap-and-trade program regulations were passed in November 2018. The program regulates the industry, power, heat (buildings), and transportation sector and covers more than 80% of GHG emissions in Nova Scotia.

Québec’s Cap-and-Trade System for GHG emissions became operational in 2013. Québec has been a member of the Western Climate Initiative since 2008 and formally linked its system with California in January 2014 and with Ontario’s in January 2018 (until the termination of Ontario’s ETS in mid-2018). The system covers fossil fuel combustion and industrial emissions in power, buildings, transport, and industry.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

PJM's AI Power Crisis Just Got a 250MW Hydrogen Answer

Inside This Issue ⚡ Plug Power Plans Hydrogen Offering in Top US Power-Grid Auction 🪨 Underground CO2 Storage, X-Rays Reveal Carbon Capture Capacity of Volcanic Rocks 🍁 Swiss Carbon Capture Compan...

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

Company Announcements

-

Plug Power Plans Hydrogen Offering in Top US Power-Grid Auction

Plug Power Inc. is planning to offer hydrogen electricity in a potential special auction by the biggest US power grid in the scramble to feed the artificial intelligence boom. (Bloomberg) — Plug P...

-

Governor Ferguson, Ecology Director Sixkiller Issue Statements About The Significance Of This Milestone OLYMPIA -- Today Washington, California, and Québec released a draft linkage agreement for p...

-

Partners Seek Minnesota Renewable Development Account Funding to Support Necessary Infrastructure; CleanCounts to Enhance Registry Capabilities for Ammonia Energy Attribute Certificates TRUMAN, Mi...

-

Carbon Removal Coalition Forms With Goal of Attracting $100-million in Project Investments

Leaders in Canada’s nascent carbon-removal industry have joined with several corporate and financial backers as well as the federal government in a bid to attract $100-million in project investment...