A Step Forward in Carbon Credit Transparency

The voluntary carbon market (VCM) is seeing a notable improvement in carbon credit quality, according to a new analysis from Calyx Global and ClearBlue Markets. Their latest report highlights how standardized quality and price assessments are reshaping the market and influencing pricing trends.

This research is built on two newly developed indices: the Calyx Carbon Integrity Index and the Calyx-ClearBlue Carbon Price-Integrity Index. These benchmarks are designed to provide greater transparency and help stakeholders navigate the evolving carbon credit landscape.

Addressing a Longstanding Market Challenge

For years, carbon credit quality has been difficult to measure, leading to inconsistencies in pricing and trust issues among investors, businesses, and policymakers. These indices now offer a standardized way to assess both price and quality, making it easier to differentiate high-integrity credits from less reliable ones.

The data supporting these indices is outlined in the newly released report, "State of Quality and Price in the VCM". This report aims to provide valuable insights into market trends and inform strategic decision-making for carbon credit buyers and sellers.

Why These Indices Matter

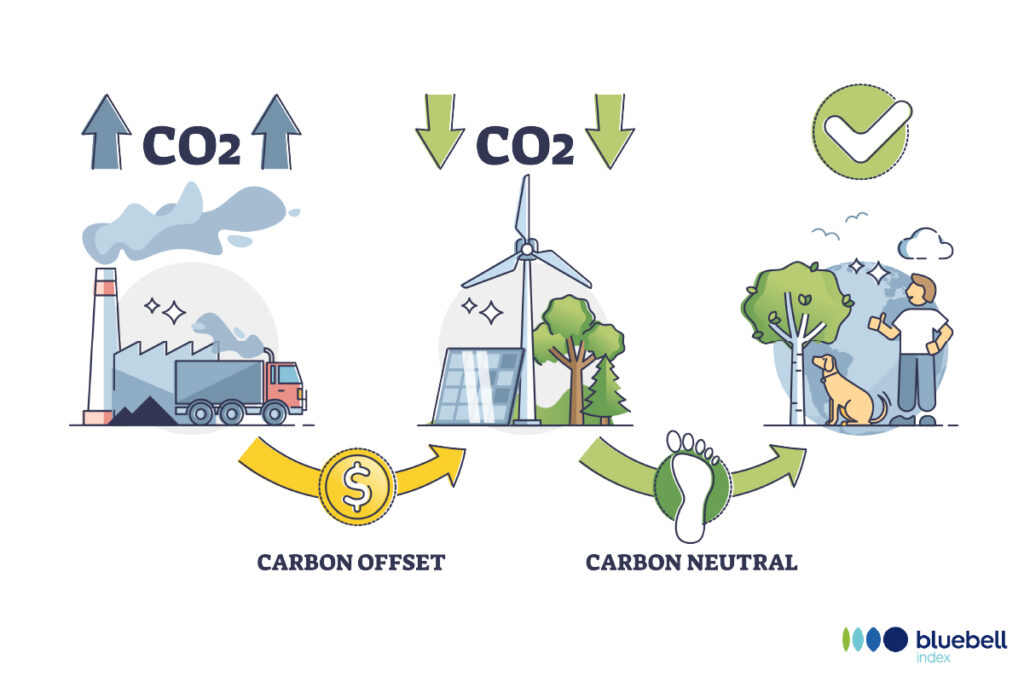

The voluntary carbon market plays a critical role in global climate goals, allowing businesses to offset emissions and invest in sustainability projects. However, without clear quality benchmarks, buyers have struggled to assess the true impact of their credits. These new indices aim to bridge that gap by:

- Providing a transparent framework for evaluating carbon credit integrity.

- Encouraging high-quality credit purchases over low-impact offsets.

- Stabilizing pricing trends by aligning cost with verified quality.

Market Shifts: Quality Over Volume

One of the most significant trends observed is a clear shift towards quality-driven purchasing decisions. Buyers are prioritizing integrity over sheer volume, reflecting a broader industry movement toward credible climate action.

“The voluntary carbon market can be an impactful mechanism for achieving global climate goals, but its long-term success depends on trust and transparency,” said Duncan van Bergen, Co-founder of Calyx Global. “With the launch of these indices, we’re empowering companies and investors to gain a deeper understanding of the level of risk and real improvements in the market.”

The stabilization of prices, particularly for removal-based credits, is another key finding. These credits—generated from projects that physically remove CO₂ from the atmosphere—are seeing increased demand and consistent pricing, further emphasizing the market’s commitment to high-integrity solutions.

>> In Other News: Direct Ocean Capture Takes a Big Step Forward with Captura's New Pilot Plant in Hawaii

What This Means for Businesses and Investors

For companies looking to offset emissions, the ability to evaluate credit quality is essential. These indices provide a clearer picture of risk and value, helping organizations make more informed investment decisions. Investors, meanwhile, gain greater confidence in market stability, knowing that pricing is more accurately aligned with quality.

“The voluntary carbon market is undergoing a clear shift, with buyers increasingly prioritizing integrity over volume,” said Jennifer McIsaac, Chief Market Intelligence Officer at ClearBlue Markets. “The stabilization of prices, particularly the premium for removal-based credits, suggests that quality is becoming the key driver of market dynamics.”

Looking Ahead: The Future of Carbon Markets

As demand for high-quality carbon credits grows, companies that embrace transparency and integrity will be best positioned for long-term success. These new indices are helping to redefine industry standards, making it easier for businesses to participate in meaningful climate action.

By ensuring that price reflects quality, the market is moving towards a more sustainable and trustworthy future—one where carbon credits truly contribute to global emissions reduction goals. With these tools in place, businesses and investors can navigate the carbon market with greater confidence and clarity.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

-

$47M Just Poured Into This SAF Producer

Inside This Issue 💰 LanzaJet Announces $47M in New Capital and First Close of Equity Round at $650M Pre-Money Valuation 🚢 Maersk's Ethanol Bet Could Reshape U.S. Fuel Markets 🪨 Canada Nickel and t...

Company Announcements

-

Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid

Early plans included three or four ‘network corridors’ where hydrogen fuel-cell facilities could support railways or heavy-duty trucks Hyundai Motor Co. has proposed building hydrogen fuel-cell in...

-

The investor consortium comprising the Paris-based Next Generation Fuels Industrial & Technological fund Calderion (Audacia), alongside infrastructure developer Terravent and WenCo Family Offic...

-

The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions

The LEGO Group is continuing to develop its understanding of different approaches to carbon removal, building on initiatives launched in 2024. The expanded programme includes new nature-based and ...

-

SAFc Registry Surpasses 500,000 Metric Tons of CO₂e Abated

Registry designed to support sustainable aviation fuel buildout celebrates milestone as emissions reductions connected to environmental attribute certificates top equivalent of 255,000 JFK-Heathrow...