Phillips 66 Announces 2023 Capital Program

Published by Todd Bush on December 12, 2022

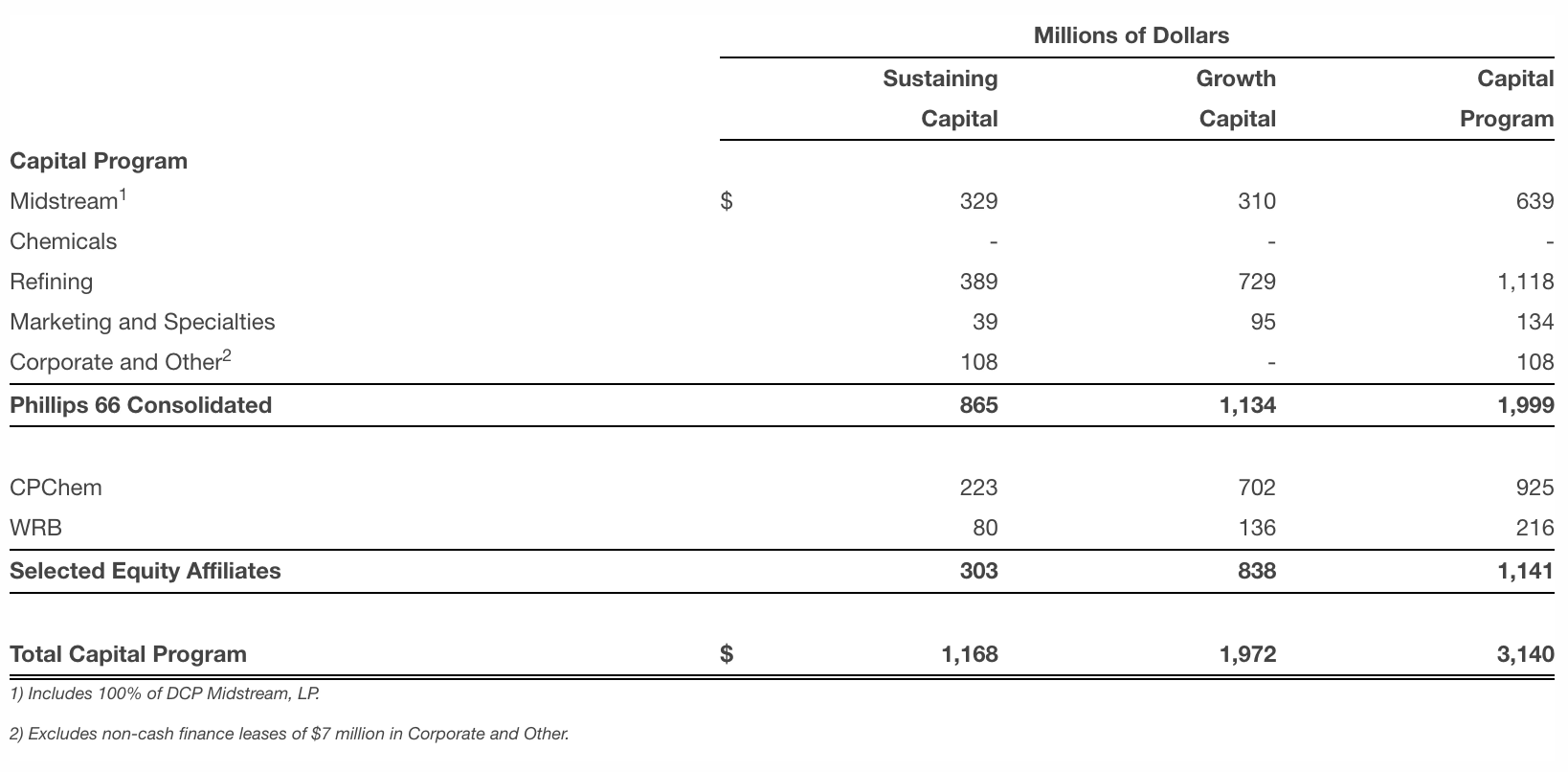

December 09, 2022 11:11 AM Eastern Standard Time HOUSTON--(BUSINESS WIRE)--Phillips 66 (NYSE: PSX) today announced a 2023 capital program of $2 billion, including $865 million for sustaining capital and $1.1 billion for growth capital. Approximately 50% of growth capital supports lower-carbon opportunities. The capital program is consistent with the company's commitment to maintain a $2 billion annual budget through 2024.

>> In Other News: Aker Carbon Capture Selected by Viridor as Partner on Pre-feed Study for Runcorn CCS

'The 2023 capital program reflects our ongoing commitment to capital discipline,' said Mark Lashier, President and CEO of Phillips 66. 'Through our Business Transformation, we are capturing $200 million of sustaining capital efficiencies while prioritizing safety and reliability. We are also investing in returns-focused growth opportunities, including enhancing our NGL platform and converting our Rodeo facility to produce lower-carbon renewable fuels.

'Additionally, the capital program supports our commitment to return $10 billion to $12 billion to shareholders between the second half of 2022 and the end of 2024 through a secure, competitive and growing dividend and share repurchases.'

The Midstream capital plan of $639 million comprises $329 million for sustaining projects and $310 million for growth projects. Growth capital will be directed toward enhancing the company's integrated NGL value chain from wellhead to market. The Midstream expected spend includes 100 percent of DCP Midstream, LP's sustaining capital of $150 million and $125 million of growth capital.

In Refining, Phillips 66 plans to invest $1.1 billion, including $389 million for reliability, safety and environmental projects. Refining growth capital of $729 million includes the continuing conversion of the San Francisco Refinery in Rodeo, California, into one of the world's largest renewable fuels facilities. The conversion will reduce emissions from the facility and produce lower carbon-intensity transportation fuels. Refining growth capital will also support opportunities for high-return, low-capital projects to improve asset reliability and market capture.

The Marketing and Specialties capital plan reflects the continued development and enhancement of the company's retail network, including energy transition opportunities.

Corporate and Other capital will primarily fund digital transformation and information technology projects.

Phillips 66's proportionate share of capital spending by joint ventures Chevron Phillips Chemical Company LLC (CPChem) and WRB Refining LP (WRB) is expected to total $1.1 billion and be self-funded.

CPChem's growth capital will fund construction of an integrated polymers facility on the U.S. Gulf Coast. The facility, expected to begin operations in 2026, will include a 4,600 million pounds per year ethane cracker and two 2,200 million pounds per year high-density polyethylene units. CPChem continues expansion of its propylene splitting capacity and normal alpha olefins production, as well as other optimization and debottleneck opportunities. In addition, CPChem will continue development of a world-scale petrochemical project in Ras Laffan, Qatar, with a final investment decision expected in early 2023.

WRB's capital spending will be directed to sustaining projects, crude flexibility and enhancing clean product yield.

Including Phillips 66's proportionate share of capital spending associated with joint ventures CPChem and WRB, the company's total 2023 capital program is projected to be $3.1 billion.

1) Includes 100% of DCP Midstream, LP.

2) Excludes non-cash finance leases of $7 million in Corporate and Other.

About Phillips 66

Phillips 66 (NYSE: PSX) manufactures, transports and markets products that drive the global economy. The diversified energy company's portfolio includes Midstream, Chemicals, Refining, and Marketing and Specialties businesses. Headquartered in Houston, Phillips 66 has employees around the globe who are committed to safely and reliably providing energy and improving lives while pursuing a lower-carbon future. For more information, visit phillips66.com or follow @Phillips66Co on LinkedIn or Twitter.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE 'SAFE HARBOR' PROVISIONS

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements within the meaning of the federal securities laws. Words such as 'anticipated,' 'estimated,' 'expected,' 'planned,' 'scheduled,' 'targeted,' 'believe,' 'continue,' 'intend,' 'will,' 'would,' 'objective,' 'goal,' 'project,' 'efforts,' 'strategies' and similar expressions that convey the prospective nature of events or outcomes generally indicate forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements included in this news release are based on management's expectations, estimates and projections as of the date they are made. These statements are not guarantees of future performance and you should not unduly rely on them as they involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include: the effects of any widespread public health crisis and its negative impact on commercial activity and demand for refined petroleum products; the inability to timely obtain or maintain permits necessary for capital projects; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the renewable fuel standards program, low carbon fuel standards and tax credits for biofuels; fluctuations in NGL, crude oil, and natural gas prices, and petrochemical and refining margins; our ability to consummate the proposed transaction to acquire all of the publicly-held common units of DCP Midstream, LP (DCP Midstream) and the timing and cost associated therewith; our ability to achieve the expected benefits of the integration of DCP Midstream and from the proposed transaction, if consummated; the diversion of management's time on transaction- and integration-related matters; the success of the company's Business Transformation initiatives and the realization of savings from actions taken in connection therewith; unexpected changes in costs for constructing, modifying or operating our facilities; unexpected difficulties in manufacturing, refining or transporting our products; the level and success of drilling and production volumes around our Midstream assets; risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products, renewable fuels or specialty products; lack of, or disruptions in, adequate and reliable transportation for our NGL, crude oil, natural gas, and refined products; potential liability from litigation or for remedial actions, including removal and reclamation obligations under environmental regulations; failure to complete construction of capital projects on time and within budget; the inability to comply with governmental regulations or make capital expenditures to maintain compliance; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets, which may also impact our ability to repurchase shares and declare and pay dividends; potential disruption of our operations due to accidents, weather events, including as a result of climate change, acts of terrorism or cyberattacks; general domestic and international economic and political developments including armed hostilities (including the Russia-Ukraine war), expropriation of assets, and other political, economic or diplomatic developments; international monetary conditions and exchange controls; changes in governmental policies relating to NGL, crude oil, natural gas, refined petroleum products, or renewable fuels pricing, regulation or taxation, including exports; changes in estimates or projections used to assess fair value of intangible assets, goodwill and property and equipment and/or strategic decisions with respect to our asset portfolio that cause impairment charges; investments required, or reduced demand for products, as a result of environmental rules and regulations; changes in tax, environmental and other laws and regulations (including alternative energy mandates); political and societal concerns about climate change that could result in changes to our business or increase expenditures, including litigation-related expenses; the operation, financing and distribution decisions of equity affiliates we do not control; and other economic, business, competitive and/or regulatory factors affecting Phillips 66's businesses generally as set forth in our filings with the Securities and Exchange Commission. Phillips 66 is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Information — The disaggregation of capital spending between sustaining and growth is not a distinction recognized under generally accepted accounting principles in the United States. The company provides such disaggregated information to demonstrate management's return expectations with respect to capital spending.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

Company Announcements

-

Carbon Removal Coalition Forms With Goal of Attracting $100-million in Project Investments

Leaders in Canada’s nascent carbon-removal industry have joined with several corporate and financial backers as well as the federal government in a bid to attract $100-million in project investment...

-

New Coalition Targets $100M for Canadian Carbon Removal Projects by 2030

An emerging industry to remove carbon dioxide out of the atmosphere got a boost on Thursday with the launch of an initiative to raise another $100 million for those projects. An emerging industry ...

-

TOKYO, March 6, 2026 /CNW/ - Canada is focused on what we can control – strengthening our economy at home and diversifying our partnerships abroad, including in the Indo-Pacific. Japan is an over $...

-

The Government of Canada, BMO, ClimeFi, NorthX, RBC, Shopify, and Vancity launch the "Advance Carbon Removal Coalition" to advance demand for Canadian CDR. OTTAWA, ON, March 5, 2026 /CNW/ - Canada...