Wintershall Dea and Equinor partner up for large-scale CCS value chain in the North Sea

Published by Todd Bush on August 30, 2022

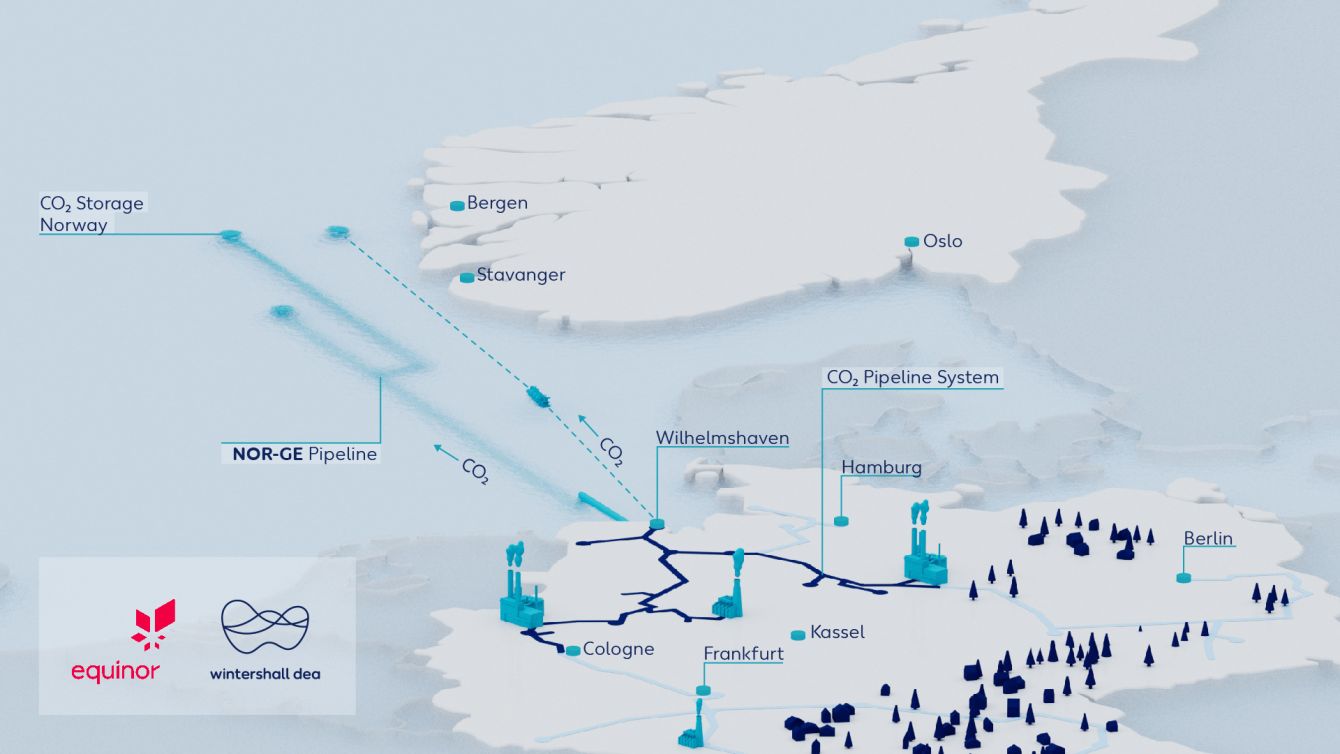

- Comprehensive CCS project connecting Germany and Norway

- CO2 transportation from continental Europe and storage on the Norwegian Continental Shelf

- Estimated pipeline capacity of 20 to 40 million tonnes per year by 2037

- Reconfirming the companies’ commitment to meeting EU climate targets

Wintershall Dea and Equinor have agreed to pursue the development of an extensive and safe Carbon Capture and Storage (CCS) value chain connecting continental European CO2 emitters to offshore storage sites on the Norwegian Continental Shelf. The ambition of the Norwegian-German CCS project ‘NOR-GE’ is to make a vital contribution to reducing greenhouse gas emissions in Europe.

“Wintershall Dea and Equinor will work together to establish technical and commercial solutions for the development of cross-border CCS value chains in Europe and work with governments to shape a regulatory framework that can enable this. We will build on our close cooperation and open the next chapter of German-Norwegian partnership”, commented Mario Mehren, CEO of Wintershall Dea.

Through the partnership, both companies are responding to the European demand for the large-scale decarbonisation of carbon-intensive industries that need safe and large-scale underground CO2 storage to abate unavoidable emissions from their processes. The partnership intends to connect Germany, the largest CO2 emitter in Europe, and Norway, which has Europe’s largest CO2 storage potential.

“This is a strong energy partnership supporting European industrial clusters’ need to decarbonise their operations. Wintershall Dea and Equinor are committed to the energy transition and will utilise the competence and experience of both companies to work with governments and partners to help reach the net-zero target”, said Anders Opedal, CEO and President of Equinor.

An approximately 900-kilometre-long open access pipeline is planned to connect the CO2 collection hub in Northern Germany and the storage sites in Norway and is aimed to be commissioned by 2032. It is expected to have a capacity of 20 to 40 million tonnes of CO2 per year – equivalent to around twenty per cent of all German industrial emissions per year1. The project will also consider an early deployment solution where CO2 is planned to be transported by ship from the CO2 export hub to the storage sites.

Wintershall Dea and Equinor also plan to jointly apply for offshore CO2 storage licences, aiming to store between 15 and 20 million tonnes per year on the Norwegian Continental Shelf.

Wintershall Dea has a clear ambition to become net zero across upstream activities by 2030 (scope 1 and 2 on an equity share basis), to further develop its gas-weighted portfolio in Norway, and to build up a CCS and hydrogen business. Wintershall Dea has gained valuable expertise in the Greensand Project in the Danish North Sea and in addition is a partner in Equinor’s Snøhvit CCS project.

Equinor is an international energy company with 21.000 employees worldwide, committed to long-term value creation in a low-carbon future. Equinor’s purpose is to turn natural resources into energy for people and progress for society. Equinor’s portfolio of projects encompasses oil and gas, renewables and low-carbon solutions, with an ambition of becoming a net-zero energy company by 2050.

(1) 181mtpa, 2021. Umwelt Bundesamt.

ABOUT CARBON CAPTURE AND STORAGE

Carbon capture and storage (CCS) is an available, safe, reliable, and affordable technology. CCS involves capturing CO2, for example from power plants or industrial facilities, and storing it long-term in underground geological structures, such as depleted offshore gas and oil reservoirs or deep saline aquifers. CCS enables the reliable and low-cost decarbonisation of sectors with CO2 emissions that are difficult or impossible to avoid. The International Energy Agency (IEA), among other leading organizations, believes that CCS will play a key role in climate protection – and emphasizes that ambitious climate targets cannot be achieved without it.

About Wintershall Dea

Wintershall Dea is Europe’s leading independent natural gas and oil company with more than 120 years of experience as an operator and project partner along the entire E&P value chain. The company with German roots and headquarters in Kassel and Hamburg explores for and produces gas and oil in 13 countries worldwide in an efficient and responsible manner. With activities in Europe, Russia, Latin America and the MENA region (Middle East & North Africa), Wintershall Dea has a global upstream portfolio and, with its participation in natural gas transport, is also active in the midstream business. More in our annual report.

As a European gas and oil company, we support the EU's 2050 carbon neutrality target. As our contribution we have set ourselves ambitious targets: We want to be net zero across our entire upstream operations – both operated and non-operated – by 2030. This includes Scope 1 (direct) and Scope 2 (indirect) greenhouse gas emissions on an equity share basis. Wintershall Dea will also bring its methane emissions intensity below 0.1 per cent by 2025 and maintain zero routine flaring of associated gas in its operations. In addition, we plan to reduce emissions resulting from the use of hydrocarbons by applying CCS and low-carbon hydrogen technologies, potentially building up a business abating 20-30 million tonnes of CO2 per annum by 2040. You can find more about this in our Sustainability Report.

Wintershall Dea was formed from the merger of Wintershall Holding GmbH and DEA Deutsche Erdoel AG, in 2019. Today, the company employs around 2,500 people worldwide from almost 60 nations.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

Company Announcements

-

Carbon Removal Coalition Forms With Goal of Attracting $100-million in Project Investments

Leaders in Canada’s nascent carbon-removal industry have joined with several corporate and financial backers as well as the federal government in a bid to attract $100-million in project investment...

-

New Coalition Targets $100M for Canadian Carbon Removal Projects by 2030

An emerging industry to remove carbon dioxide out of the atmosphere got a boost on Thursday with the launch of an initiative to raise another $100 million for those projects. An emerging industry ...

-

TOKYO, March 6, 2026 /CNW/ - Canada is focused on what we can control – strengthening our economy at home and diversifying our partnerships abroad, including in the Indo-Pacific. Japan is an over $...

-

The Government of Canada, BMO, ClimeFi, NorthX, RBC, Shopify, and Vancity launch the "Advance Carbon Removal Coalition" to advance demand for Canadian CDR. OTTAWA, ON, March 5, 2026 /CNW/ - Canada...